Powering Financial Innovation with Security, Scalability, and Efficiency.

Gap Core is a next-generation financial software solution designed to revolutionize banking and financial services. Built for scalability, security, and seamless integration, Gap Core empowers financial institutions, fintech companies, and businesses with innovative tools to optimize operations and enhance customer experiences.

Our Mission

“Gap Core is designed to provide financial institutions and businesses with robust, user-friendly, and scalable banking solutions. It drives financial inclusion and operational excellence through advanced technology, personalized support, and unwavering integrity.”

Our Vision

“We envision a future where financial services are fully integrated, accessible, and limitless. Gap Core transforms how institutions and businesses manage and deliver banking services, breaking barriers and creating new opportunities for financial growth and success.”

00+

Onboarded

00+

Feedbacks

00+

Workers

00+

Contributors

What Defines Us

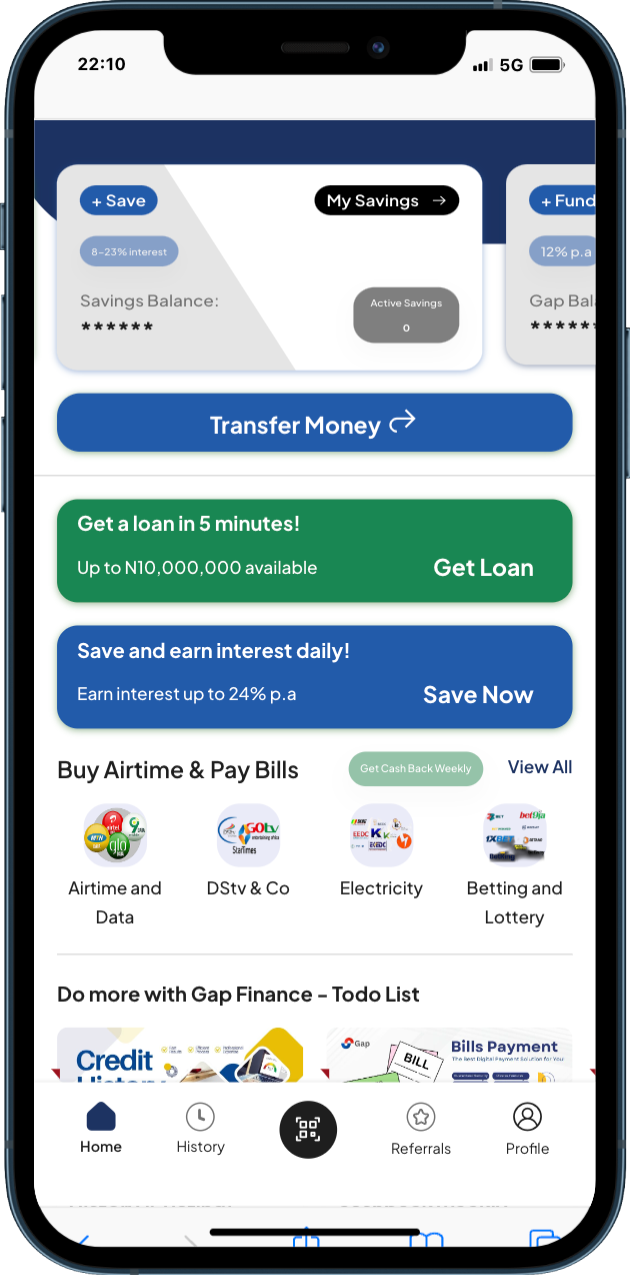

Explore the diverse financial solutions offered by Gap Finance and discover how we can help you achieve your goals. Whether you’re a fintech seeking BaaS solutions or an individual looking for streamlined financial management, Gap Finance is here to provide the support and innovation you need.

End-to-End Core Banking Solution

We provide a fully integrated Core Banking as a Service (CBaaS) that enables banks, fintechs, and microfinance institutions to run their operations efficiently without heavy infrastructure investments.

Scalable & Flexible Deployment

Our platform supports cloud-based, on-premise, and hybrid models, allowing financial institutions to scale seamlessly based on their growth needs.

API-Driven & Open Banking Ready

GapCore offers fully documented open APIs, making it easy for banks to integrate with payment gateways, digital wallets, and third-party financial services.

Multi-Channel Digital Banking

We enable institutions to provide mobile banking, internet banking, USSD services, and POS integrations, ensuring 24/7 digital access for customers.

Compliance & Security First

Our platform is ISO 27001-certified and fully compliant with local and international financial regulations (KYC, AML, GDPR), ensuring secure and compliant banking operations.

Cost-Effective & Rapid Deployment

With a subscription-based model and quick go-live process, banks and fintechs can launch and scale banking services without large upfront costs.