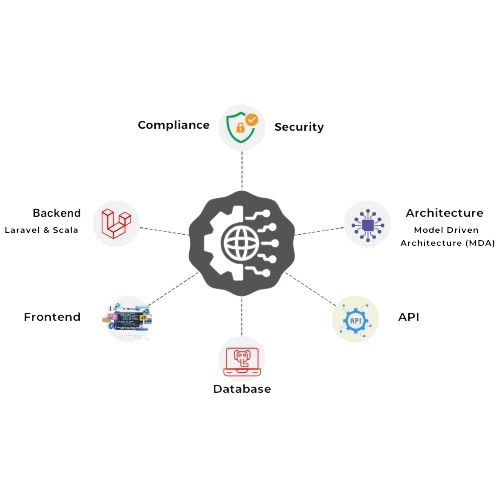

Architecture & Technology Stack

Our hosting and database comply with local regulations, featuring ISO 27001, Tier 3 data centers, encrypted backups, DDoS protection, and separate instances per customer, while ensuring interoperability with an OpenAPI-standard approach.

- Laravel & Scala

- Transactional & Analytical DBs

- Stable & Scalable Backend

- Blade Templating With CSS & JS